The United Kingdom is witnessing a significant exodus of its wealthiest residents, a trend fueled by recent changes in tax regulations. This shift in residency is impacting the nation’s economic landscape and prompting a re-evaluation of its attractiveness as a haven for high-net-worth individuals. Reports indicate a substantial outflow of wealth, with thousands of millionaires choosing to relocate their assets and themselves to more tax-friendly jurisdictions. This article delves into the reasons behind this هجرة المليونيرات (Millionaire Migration), highlighting prominent cases and the broader implications for the UK economy.

تغييرات ضريبية تدفع أصحاب الملايين للخروج من بريطانيا (Tax Changes Driving Millionaires Out of Britain)

For decades, the UK, particularly London, has been a magnet for global wealth. This was largely due to a favorable tax regime that allowed non-domiciled residents – those who consider their permanent home to be outside the UK – to avoid paying UK taxes on their overseas income and gains. They were only taxed on income sourced within the UK. This attracted a diverse group of international entrepreneurs, investors, and business leaders, bolstering the UK’s financial sector and contributing to its economic growth.

However, this landscape began to shift in March 2024. The Conservative government implemented stricter tax rules, shortening the period of tax exemption for non-domiciled residents. Previously, they could avoid paying UK tax on foreign income for up to ten years. The new regulations reduced this to four years, compelling many to reassess their residency status. Furthermore, the Labour party, under Keir Starmer, has pledged to eliminate inheritance tax exemptions on assets held in foreign investment funds, adding another layer of financial pressure.

حالة محمد منصور: مثال بارز على هجرة الثروات (Mohamed Mansour’s Case: A Prominent Example of Wealth Migration)

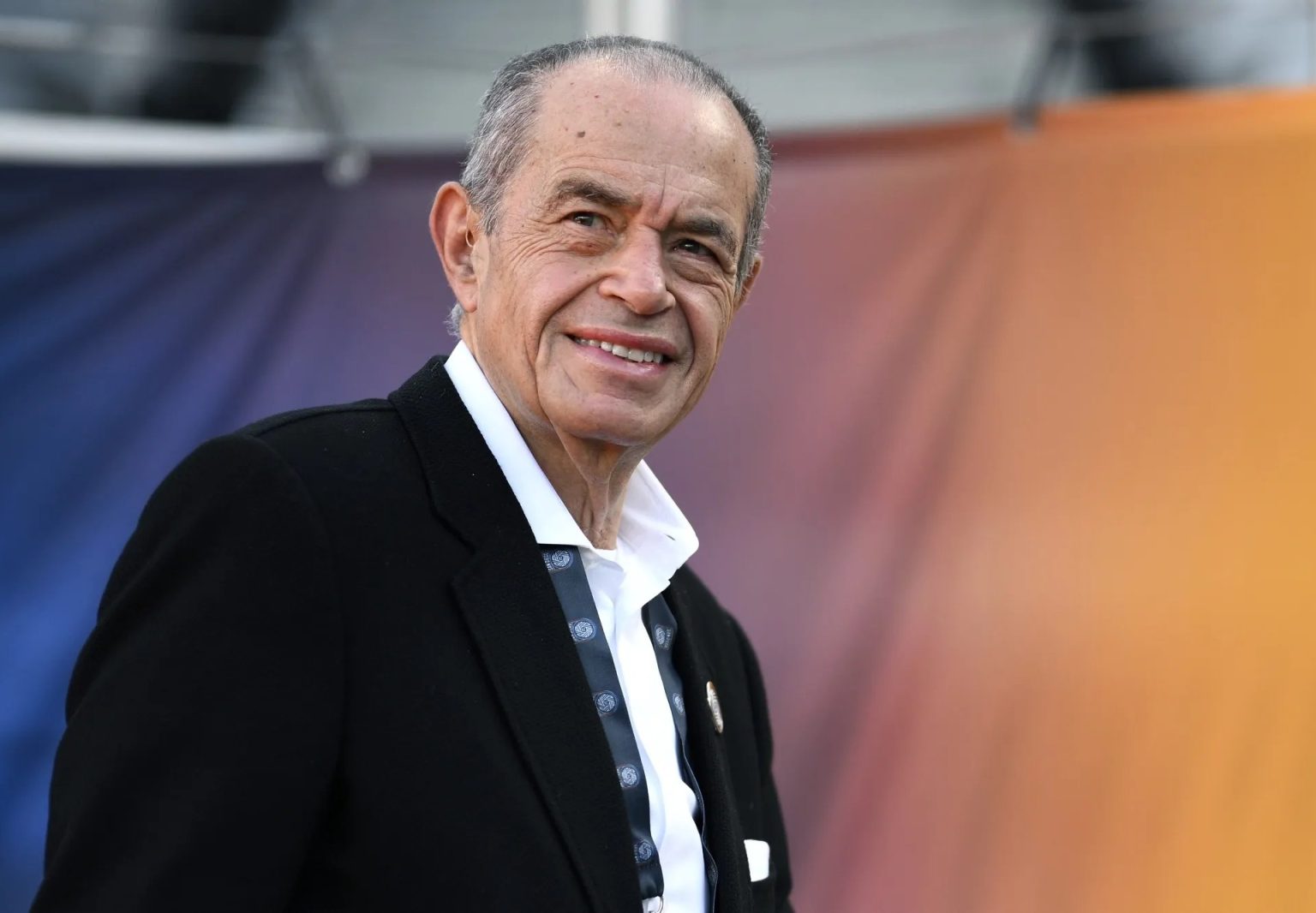

The recent decision of Egyptian-British billionaire Mohamed Mansour (77) to officially relocate his residency to Egypt serves as a stark example of this trend. According to filings with UK Companies House, as reported by Bloomberg, Mansour is no longer a UK resident, having resided there since 2016.

Mansour’s wealth, estimated at $3.4 billion by Forbes in 2025, places him eighth among the wealthiest businessmen in Africa. His move isn’t isolated; it reflects a broader pattern of wealthy individuals seeking more advantageous tax environments. This هجرة رؤوس الأموال (Capital Flight) is a direct consequence of the changing fiscal policies in the UK.

أسباب أخرى وراء مغادرة الأثرياء (Other Reasons Behind the Departure of the Wealthy)

Beyond the specific tax changes, several other factors contribute to the growing trend of هجرة الأثرياء (Wealthy Emigration). Concerns about political stability, the rising cost of living in London, and the desire for greater privacy are all playing a role.

The UK’s increasingly complex regulatory environment is also a deterrent for some. Individuals and families are seeking simpler, more predictable tax systems and a more stable political climate. Destinations like Monaco, Singapore, Switzerland, and the United States are actively courting this wealth, offering attractive tax incentives and a high quality of life. Some, like Mansour, are also choosing to return to their countries of origin. Bloomberg also reported on Truls Paulsen, founder of the renowned clothing company “Best Seller,” who recently decided to return to his native Denmark.

أنشطة منصور في المملكة المتحدة ودوره السياسي (Mansour’s Activities in the UK and His Political Role)

Mohamed Mansour’s involvement in the UK extended beyond investment. In 2023, he donated £5 million (approximately $6.7 million) to the Conservative Party. Prior to that, in 2022, he was appointed Treasurer of the party by then-Prime Minister Rishi Sunak, giving him a significant role in overseeing its finances and fundraising activities.

His contributions were recognized with a knighthood in the past year, officially becoming “Sir Mohamed Mansour.” Mansour founded “Man Capital” in London, a firm that invests in various sectors, including technology, financial services, and sports clubs. His family also owns “Mansour Group” in Egypt, representing General Motors and Caterpillar, alongside a diverse portfolio of other investments.

الآثار المترتبة على الاقتصاد البريطاني (Implications for the British Economy)

The ongoing هجرة المليونيرات poses a significant challenge to the UK economy. The loss of these high-net-worth individuals translates to a reduction in tax revenue, potentially impacting public services and infrastructure projects. Furthermore, the outflow of capital can stifle investment and economic growth. The UK risks losing its status as a global financial hub if it fails to address the concerns of its wealthiest residents.

The Guardian previously highlighted the potential impact of the inheritance tax changes, describing them as an “emotional driver” for wealthy individuals, particularly those of advanced age, to leave the UK for fear of their families losing a substantial portion of their wealth.

In conclusion, the recent changes to the UK’s tax laws are triggering a notable exodus of millionaires, as exemplified by the case of Mohamed Mansour. This trend, driven by a desire for more favorable tax environments and increased financial security, has significant implications for the British economy. Addressing these concerns and maintaining the UK’s attractiveness as a global financial center will require a careful re-evaluation of its tax policies and a commitment to fostering a stable and predictable investment climate. Further research into the long-term effects of this wealth migration is crucial for policymakers to develop effective strategies to mitigate the potential economic consequences.